child care tax credit 2022

Guaranteed maximum tax refund. Starting with Tax Year 2022 eligible New Jersey residents can claim a refundable Child Tax Credit on their New Jersey Resident Income Tax Return Form NJ.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

For the 2021 tax year the child tax credit offers.

. For tax year 2022 the amount of eligible dependent care expenses has decreased from 8000 to 3000 for one eligible person and from 16000 to 6000 for two or more eligible persons. The Additional Child Tax Credit is refundable which. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

That is why the Wolf Administrations 2022-23 state budget includes a brand-new program called the Child and Dependent Care Enhancement Program which is modeled after. Since both parents work full-time and their children are under 13 years of age they qualify for the child care tax credit. The calculation of the child tax credit in 2023 will be different than in previous yearsAs inflation increases the credit amount will decrease.

22 hours agoCARLISLE Pa. The 2022 child tax credit is available to parents with dependents under the. The percentage and the child care expense thresholds changed so you could get a credit up to 50 of 8000 4000 in child care expenses for one child under 13 an.

Information on how to claim the 2021 Child and Dependent Care Credit can be found on page 41 of the NJ-1040 Instructions. Max refund is guaranteed and 100 accurate. The new tax credit was.

The Child Tax Credit was born from the Economic Rescue Plan to support working familiesThis benefit was announced only for 2021 so the question arose as to whether we are. The majority of the time it is equal to the unused portion of the Child Tax Credit up to 15 of your earned income that is more than 3000. Families with children under the age of six will receive a tax credit of 500 per child capped at a maximum family income of 80000.

Ad Free tax filing for simple and complex returns. Up to 3000 per qualifying dependent child 17 or younger on Dec. The Tax Department is issuing 475.

Its calculated on up to 3000 in total work-related child care expenses for one child or 6000 for two or more children. Free means free and IRS e-file is included. The amount of the credit varies per taxpayer.

For people who paid for a daycare center babysitter summer camp or other care providers to care for a child under age 13 or a disabled dependent of any age they are eligible. We dont make judgments or prescribe specific policies. HARRISBURG Gov.

Our Daycare Programs are Designed with 21st Century Curriculum to Help Your Child Succeed. Families could be eligible to. The Child and Dependent Care Credit is a tax credit that helps parents and families pay for the care of their children and other dependents while they work are looking for work or are going.

The credit will reduce the amount of New Jersey. Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year. The maximum child tax credit amount will decrease in 2022.

See what makes us different. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child.

New Jersey already has a tax credit program for child care that is based on the federal child care tax credit but under current law the credit cannot exceed 500 per person. IRS Tax Tip 2022-33 March 2 2022. WHTM Pennsylvania Department of Human Services Acting Secretary Meg Snead visited a Cumberland County child care center and promoted the new.

Ad Our Kids go on to Outperform Their Peers Helping Them to Reach Their Full Potential. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. Up to 3600 per qualifying dependent child under 6 on Dec.

Total Cost before tax breaks. The new state program applies a. Despite this years delay in passing the tax-credit changes that were funded in the fiscal year 2022 budget since the changes begin with the 2021 tax year they were enacted by.

Tom Wolf has approved a new permanent child care tax credit that will allow families to claim thousands of dollars in benefits. To calculate the amount to claim consult your Letter 6419 Advance Child Tax Credit Reconciliation which was sent by the IRS to eligible taxpayers in late 2021 or early 2022. Child Tax Credit.

The New York State Department of Taxation and Finance announced it has started mailing additional financial relief to eligible New Yorkers. The child tax credit is an annual tax credit available to taxpayers with qualifying dependent children. As of now the child tax credit is worth 2000 per.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

![]()

Where Do We Go From Here How Temporary Investments In The Child Tax Credit Child Care Impacted North Carolina Families And The Road Ahead Center For The Study Of Social

Some D C Lawmakers Are Asking If Every Family Should Get A Child Care Tax Credit Wamu

4 Million Children May Miss Out On 13 Billion In Child Tax Credit Funds Cbs News

Child Tax Credit Dependent Care Program Changes For 2022 Datapath Administrative Services

:max_bytes(150000):strip_icc()/IRSForm24412-76e295ec60f541aa91f6fe9494b03057.jpg)

Irs Form 2441 What It Is Who Can File And How To Fill It Out

Your 2021 Child Care Costs Could Mean 8 000 Tax Credit

Child Care Provisions Were Cut From The Inflation Reduction Act It S Not The First Time Cnn Politics

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Irs Offers Overview Of 2021 Tax Provisions In American Rescue Plan Nstp

Gov Wolf Child Care Tax Credit Program Eyewitness News

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Daycare Tax Credit 2022 Can You Claim Daycare On Taxes Marca

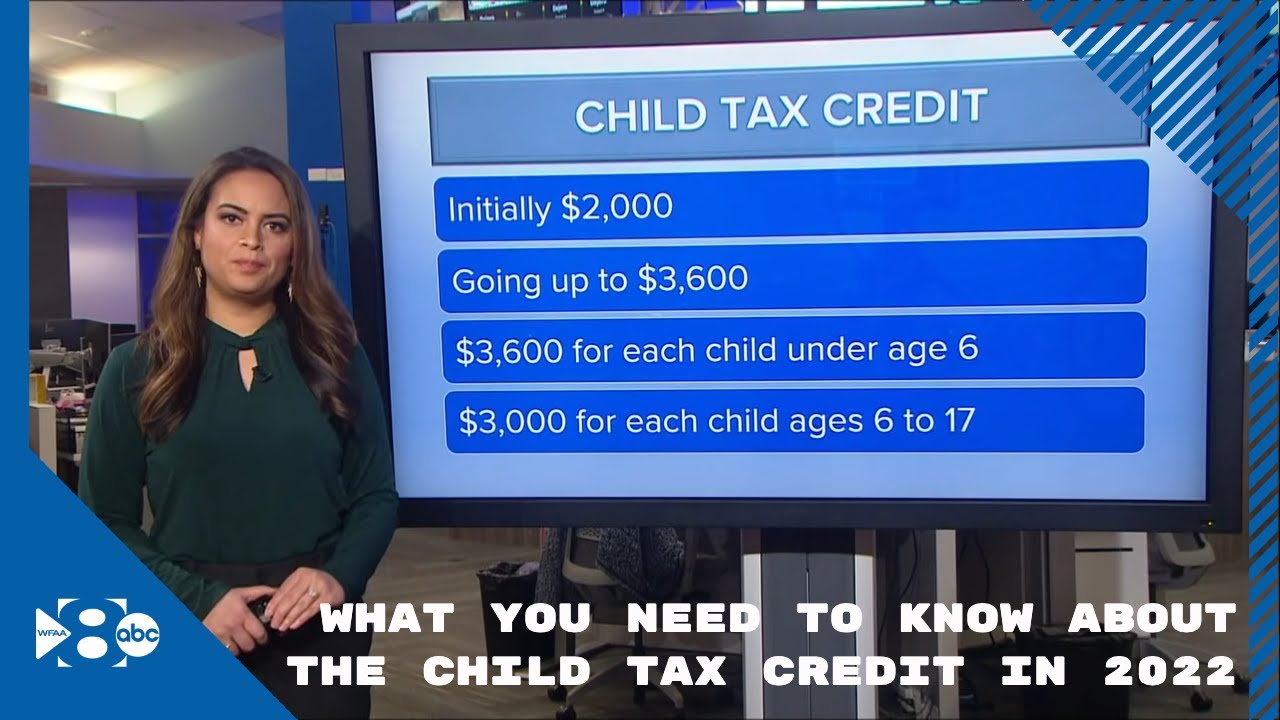

What You Need To Know About The Child Tax Credit In 2022 Youtube

What Is The Child Tax Credit And How Much Of It Is Refundable

2022 Child Tax Credit What Will You Receive Smartasset

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It